Malaysia's life insurance will expand to a $15.68b industry by 2025

Demand will be supported by the recent government measures announced.

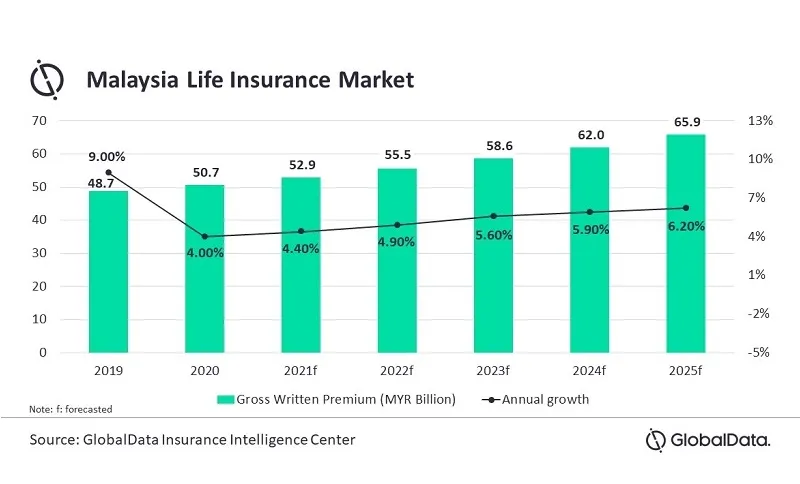

Malaysia’s life insurance industry is expected to grow to a $15.68b industry in terms of gross written premiums by 2025, from $11.98b in 2020, reports data and analytics company GlobalData.

Taking into account the aftermath of the pandemic, and the expected gradual recovery of Malaysia’s economy, GlobalData forecasts that the industry will expand at a compound annual growth rate (CAGR) of 5.38% between 2020 and 2025.

Demand for life insurance policies is expected to receive further support from recent measures announced by the government for the 2021 budget. The budget allows the withdrawal of Employees’ Provident Fund to purchase life and critical illness cover and introduces the ‘Perlindungan Tenang’ voucher program in order to provide simple and affordable microinsurance products to low-income groups.

“Malaysian life insurance industry is driven by retail consumer segment, which accounted for over 90% of total premiums in 2020,” noted Amrita Sheela, Insurance Analyst at GlobalData. However, she said that the economic slowdown and uncertainty triggered by the COVID-19 pandemic restricted consumer spending and impacted life insurance business.

“As a result, life insurance industry grew by 4% in 2020 against 9% growth registered in 2019,” Sheela added.

Lockdown restrictions in the first half of 2020 also pushed down new business premiums to a 3.2% decline in 2020, from a 14.15% growth in the previous year. The gradual opening of economic activities and increased digitization helped recovery in the second half of 2020, Sheela said.

On the other hand, premium income from renewals jumped by 6.32% in 2020, compared to 7.49% in 2019.

Renewals in 2020 were supported by benefits offered by insurers such as discounts on premiums and extension on premium renewal dates, helping customers continue their insurance coverage during the pandemic, according to GlobalData.

Increased awareness and COVID-19 assistance offered by life insurance policies encouraged policyholders to renew their policies, the report added.

“Malaysian life insurers have been successful in mitigating the impact of COVID-19 by tailoring policies and offering flexibility to customers. This, along with policy support from the government, will help drive the adoption of life insurance in the country,” Sheela concluded.

Advertise

Advertise