Natural hazard losses, inflation weigh on APAC reinsurers in 2023

Increase in costs of claims will add pressurers to profits.

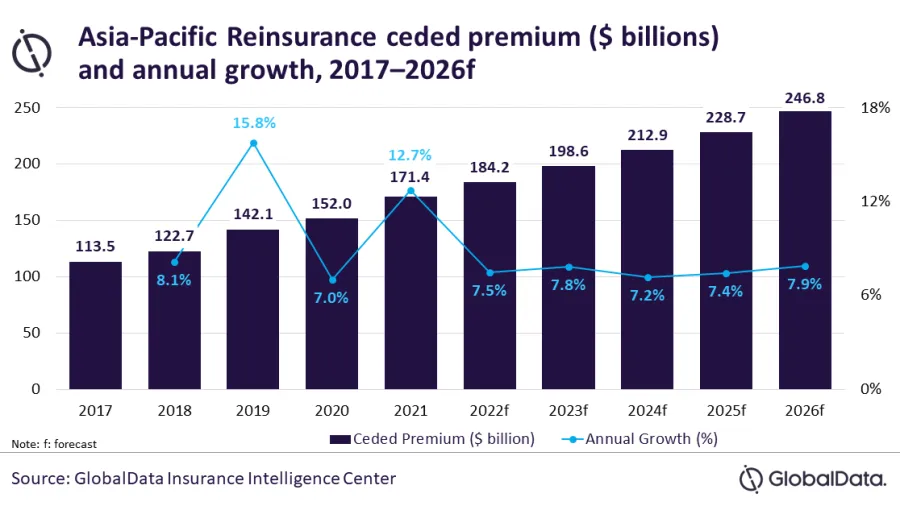

Asia Pacific reinsurance growth will be beset by natural hazard losses and inflation in 2023, reports data and analytics firm GlobalData.

“Increase in cost of claims due to the high inflation is adding pressure on reinsurers’ profitability. To reduce this, reinsurers are limiting coverage on loss-making lines, raising premiums, and pushing for higher deductibles by insurers. This in turn will prompt insurers to increase premium prices and retention levels to make a reserve for higher deductibles,” said Deblina Mitra, senior insurance analyst at GlobalData.

Mitra notes Australian insurer IAG as an example. In a January 2023 report, IAG shared that its renewal of catastrophe reinsurance programs increased retention by 75% compared to July 2022.”

Aviation, marine, cyber, political violence, and trade credit insurance lines are also expected to remain vulnerable to the ongoing Russia-Ukraine war losses in 2023.

“Insurers in the APAC region are also struggling to find suitable coverage for war risks for shipment of goods and natural gas supplies around the conflict zone as traditional reinsurers are exiting this line of business,” Mitra said.

ALSO READ: Online selling platforms are new insurance intermediaries

On the other hand, regulatory developments across the APAC region would have a positive impact on reinsurance growth over the coming years, according to Mitra.

Japan’s reinsurance industry, for example, is anticipated to benefit from the planned implementation of higher capital standards for insurers in 2025.

According to GlobalData, the regulation will likely create demand for reinsurance, as it will put pressure on life insurers to increase reinsurance to reduce asset risks.

In China, reinsurers will benefit from the new regulation on reduced entry barriers. The regulation gives preferential treatment to foreign reinsurers if their solvency regulatory system is recognized in China.

Overall, in 2023, APAC reinsurers are expected to focus on risk management and limit their loss exposure due to the Russia-Ukraine war and high inflation.

“The long-term growth, however, will remain stable due to favorable regulatory developments which will create new business opportunities for reinsurers,” Mitra said.

Advertise

Advertise