Indian life insurance industry to reach $170b in four years: Global Data

This will be bolstered by favourable regulatory policies and more.

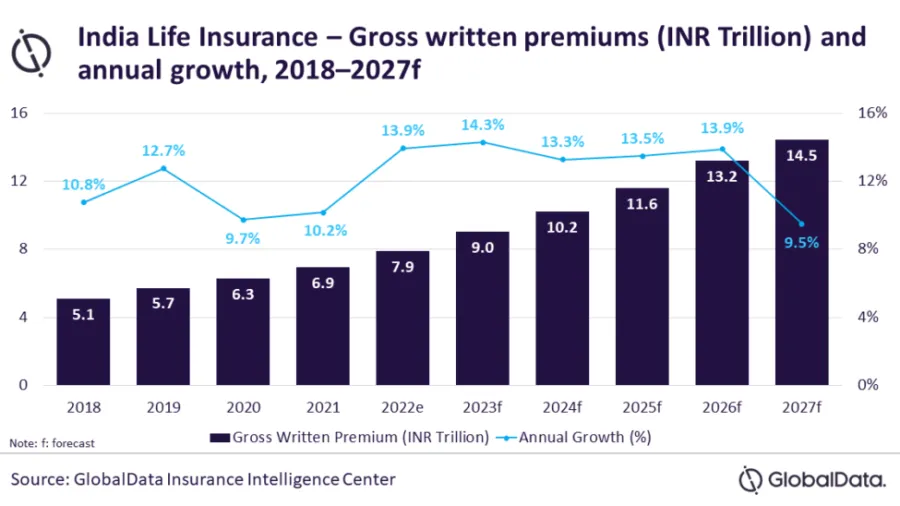

India's life insurance industry will experience a compound annual growth rate (CAGR) of 12.5% from $128.0b in 2023 to $170.6b in 2027 in terms of gross written premiums (GWP), forecasted Global Data.

The industry's growth is expected to peak at 14.3% in 2023, driven by favourable regulatory policies, increased insurance awareness, and product innovation facilitated by new insurance company licenses.

Group insurance GWP has outpaced retail insurance, growing at a CAGR of 13.3% from 2018 to 2021, while retail insurance grew at a CAGR of 11.9% during the same period.

Recent regulatory amendments in December 2022 are expected to ease life insurance operations.

The changes allow direct private equity investments in insurance companies instead of mandatory investments via special purpose vehicles (SPVs).

Insurance subsidiaries can now become promoters, enabling more capital infusion and expansion of operations.

Furthermore, the regulatory changes reduced the solvency capital margin required on certain life insurance lines, freeing up to INR 20.0 billion ($26.38 billion) for insurers to innovate products and strengthen their distribution.

ALSO READ: Non-life insurance premiums in India up 14.8% in June

To ensure insurance coverage for the entire population by 2047, the regulation eased the tie-up between corporate agents and marketing firms, allowing them to tie up with up to six insurers (from three earlier).

The regulatory sandbox framework was also extended, allowing insurers and intermediaries to experiment with new products and processes for up to 36 months, fostering market competition and supporting growth.

The entry of new players, such as Acko Life (an insurtech startup) and Credit Access Life (a micro insurer), in April 2023, is expected to further drive growth and increase insurance penetration. More insurers are likely to receive licenses in 2023.

However, starting from April 2023, non-linked policies with an annual premium exceeding $6,764.7 will be subject to tax on maturity benefits.

Since non-linked insurance accounts for 85.4% of life insurance GWP in 2022, this tax change could impact growth from 2023 to 2027.

Advertise

Advertise