Life insurance sector in Malaysia to exceed $15.9b by 2027 – GlobalData

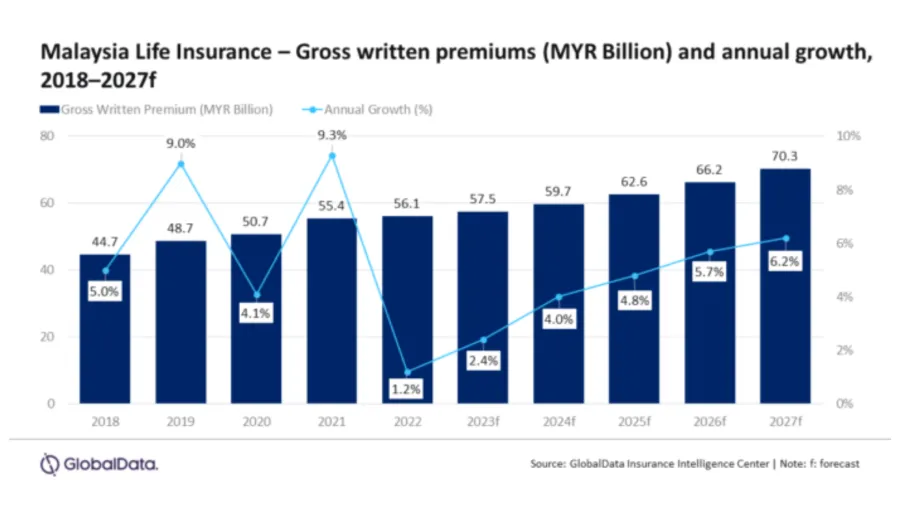

For 2023, life insurance in Malaysia is forecasted to grow 2.4%.

The Malaysian life insurance sector is projected to achieve a compound annual growth rate (CAGR) of 5.2% from $13.1b in 2023 to $15.9b in 2027, as indicated by gross written premiums (GWP), according to GlobalData.

“After witnessing strong growth of 9.3% in 2021, the Malaysian life insurance industry’s GWP witnessed a slower growth of 1.2% in 2022. The reopening of the economy after the pandemic and a lower disposable income led to a change in consumer preference away from non-essential commodities. These impacted the sales of life insurance policies in 2022,” said Manogna Vangari, Insurance Analyst at GlobalData

GlobalData's analysis suggests that Malaysia's life insurance industry will experience an estimated 2.4% growth in 2023, buoyed by increasing awareness regarding health and financial planning, the availability of cost-effective term life and endowment insurance products, as well as favourable regulatory advancements.

Among the key lines of business, endowment insurance holds the largest share in Malaysia's life insurance landscape, projected to account for 77.2% of GWP in 2023.

The popularity of endowment insurance is driven by investment-linked policies, which offer better returns compared to bank savings products and serve as a means for wealth planning. This segment is expected to grow at a CAGR of 5.5% from 2023 to 2027.

Following suit, term life insurance stands as the second-largest segment, representing a 4.6% GWP share in 2023.

ALSO READ: Top 20 APAC insurers average 8.2% in premium growth – GlobalData

Insurers in Malaysia have turned their focus to delivering low-cost and affordable plans to cater to evolving customer preferences post the COVID-19 pandemic and the challenges of high inflation.

In February 2023, the central bank of Malaysia, Bank Negara Malaysia (BNM), issued regulations to enhance transparency and bolster the sales of universal life insurance products. Additionally, BNM issued guidelines for investment-linked insurance policies, including modifications to product illustration format

“Driven by regulatory support and rising demand for low-cost life insurance policies, Malaysia’s life insurance industry is expected to be on a recovery path over the next five years. However, changing consumer preferences, rise in inflation rates, and economic uncertainties could cloud the industry’s growth.” Vangari added.

The remaining 18.1% GWP share collectively pertains to whole life and other life insurance products.

Advertise

Advertise