APAC’s liability insurance sector to exceed $61b by 2027: GlobalData

Its growth will be underpinned by robust economic development in key markets and enhanced product offerings.

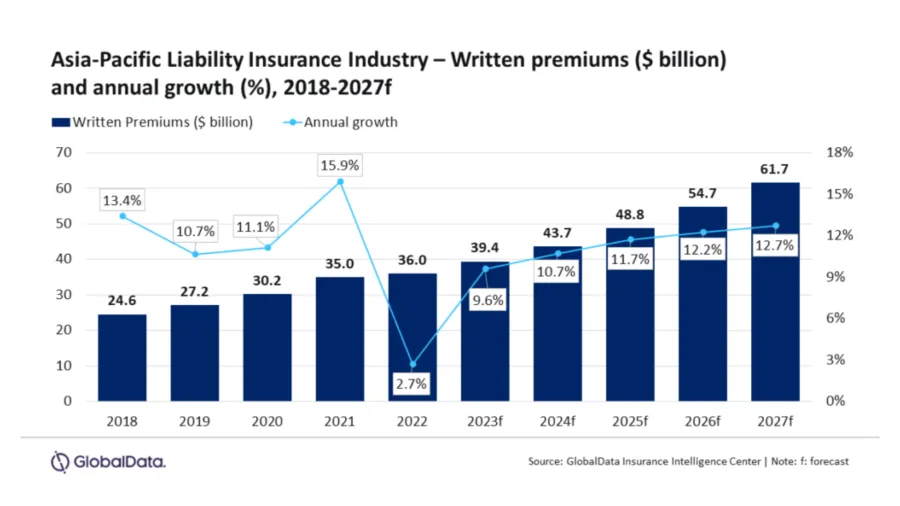

The liability insurance industry in the Asia-Pacific (APAC) region is on track for substantial growth, with projected written premiums expected to rise from $39.4b in 2023 to $61.7b in 2027, as reported by GlobalData.

GlobalData's latest report, titled 'Liability Insurance Market Trends And Analysis By Region, Line Of Business, Competitive Landscape And Forecast To 2027,' highlights that the APAC liability insurance sector is set to achieve a compound annual growth rate (CAGR) of 11.8% from 2023 to 2027.

“APAC liability insurance growth is expected to outpace the global growth over 2023-27, driven by prudential underwriting practices, new regulatory developments, and digitalization that have increased the demand for cyber insurance,” Prasanth Katam, Insurance Analyst at GlobalData said.

This growth will be underpinned by robust economic development in key markets and enhanced product offerings.

The liability insurance market in APAC is primarily concentrated in three major markets: China, Australia, and Japan, which are anticipated to contribute 48.2%, 19.6%, and 18.8%, respectively, to the region's written premiums in 2023. Among these regional leaders, China is poised to be the primary driver of liability insurance growth in APAC.

The post-pandemic reopening of the Chinese economy is expected to spur demand for liability insurance, particularly among small and medium-sized enterprises (SMEs), with China's liability insurance premiums projected to grow at a robust CAGR of 14.5% from 2023 to 2027.

ALSO READ: Top 20 APAC insurers average 8.2% in premium growth – GlobalData

In Australia, liability insurance premiums are forecasted to expand at a CAGR of 11.3% during the same period, driven by increased business from Lloyd's syndicate in workers' compensation and professional/management liability insurance.

Stable premium increments, augmented capacity, and improved underwriting conditions are anticipated to support the growth of liability insurance over the next five years.

Liability insurance written premiums in Japan are expected to grow at a CAGR of 6.8% from 2023 to 2027. This growth is attributed to increased economic activities and digitalization, which have heightened vulnerability to cyberattacks.

Japanese insurers are responding by offering cyber insurance products and expanding their consultancy services, including drills to combat email cyberattacks. Additionally, cyber insurance products covering reputational losses stemming from social media exposure are expected to gain traction in the coming years.

“Industrial pollution linked to per-and poly-fluoroalkyl substances (PFAS) is expected to be another focus area for Japanese liability insurers over the next few years,” Katam added.

Hong Kong (China SAR) ranks as the fourth largest market in the APAC region, holding a 4.3% market share in 2023. Its liability insurance written premiums are projected to grow at a CAGR of 6.6% from 2023 to 2027.

Singapore rounds out the top five regional markets, with a 1.7% market share in 2023. Liability insurance written premiums in Singapore are expected to increase at a CAGR of 7.3% from 2023 to 2027.

“An improved economy, digitalization, and growing awareness of the importance of risk management by businesses and individuals are expected to support the demand for liability insurance in the APAC region over the next five years.” said Katam.

Advertise

Advertise