Bangladesh’s general insurance industry to see 8.8% CAGR in 2027: GlobalData

Its gross written premiums will reach $809m by 2027.

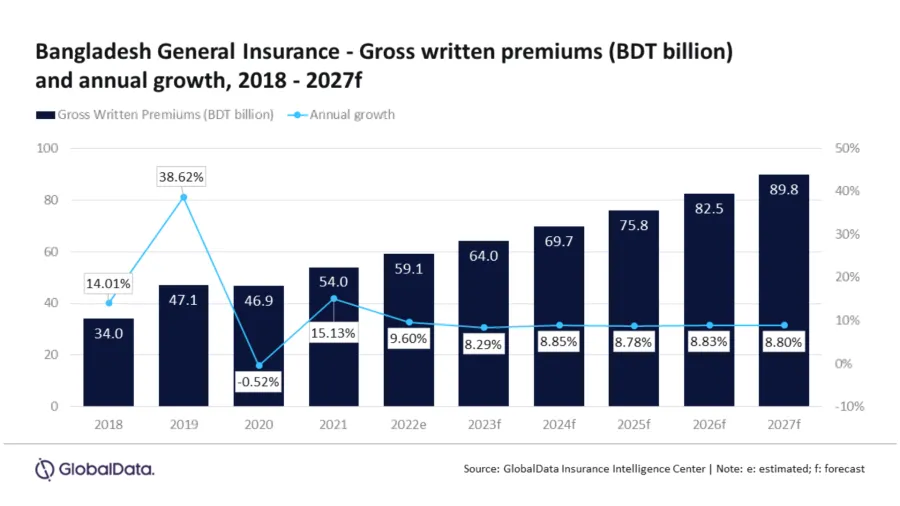

The general insurance industry in Bangladesh is poised for significant growth, with a projected compound annual growth rate (CAGR) of 8.8% from 2023 to 2027, according to GlobalData.

This growth will see gross written premiums (GWP) rise from $620.8m in 2023 to $809m in 2027.

“Bangladesh’s general insurance penetration stood at 0.15% in 2022, which is significantly lower compared to the penetration in regional economies such as India (0.95%), China (1.17%), and Japan (1.73%). To increase insurance awareness and attract new customers, the Government of Bangladesh and the Insurance Development and Regulatory Authority (IDRA) have proposed a series of steps to boost general insurance growth,” Aarti Sharma, Insurance Analyst at GlobalData commented.

In 2022, the general insurance industry in Bangladesh experienced an estimated growth rate of 9.6%, and it is expected to continue growing at a similar rate over the next five years.

This growth is supported by favourable regulatory developments aimed at improving market practices to enhance customer confidence and boost insurance penetration.

“In April 2023, the IDRA proposed changes in the solvency margins that the general insurers need to maintain their risk-bearing capacity. Insurance companies would be required to maintain the new solvency margins by establishing reserves from their profits or by injecting fresh capital,” Sharma stated.

One major development in increasing insurance penetration is the introduction of a bancassurance regulation in Bangladesh in 2023, which will allow local banks to partner with life and general insurers to sell insurance products.

ALSO READ: APAC’s liability insurance sector to exceed $61b by 2027: GlobalData

This regulation is currently awaiting approval from the Ministry of Finance and is expected to improve the financial literacy of the population and raise awareness, further supporting the growth of the insurance industry.

The previous regulation mandated general insurers to maintain a 40% risk reserve of the net written premium for all lines of business.

However, the new draft regulation specifies different reserves based on the lines of business in which the insurer operates, such as fire insurance, marine and marine hull insurance, aviation insurance, motor insurance, health insurance, and miscellaneous insurance.

To enhance insurance penetration, the Insurance Development and Regulatory Authority (IDRA) in Bangladesh is also promoting microinsurance products targeting low-income individuals.

These products cover risks related to property damage, including crop and livestock losses due to extreme weather events, making insurance more accessible to a broader segment of the population.

“Government schemes for low-cost insurance products, regulatory support, and bancassurance are expected to play a pivotal role in increasing insurance penetration in Bangladesh over the next five years and supporting growth in the general insurance business.” Sharma added.

Advertise

Advertise