Australia’s general insurance sector to surge 9.1% by 2027

The industry is seen to grow by 9.5% in 2023 and 9.8% in 2024.

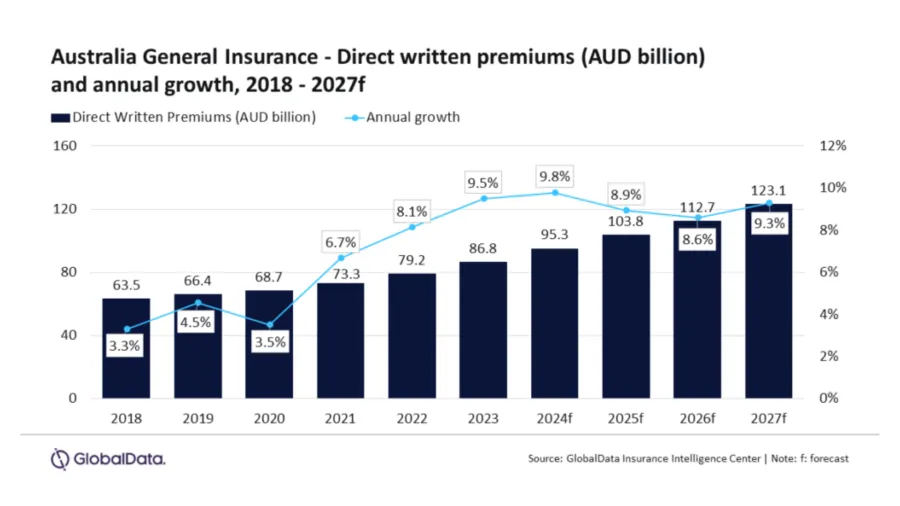

The Australian general insurance industry is forecasted to grow at a compound annual growth rate (CAGR) of 9.1%, from $60.1b in 2023 to $83.9b in 2027 in terms of direct written premiums (DWP), GlobalData said.

Meanwhile, the industry is projected to grow by 9.5% in 2023 and 9.8% in 2024.

“The Australian general insurance industry has witnessed an upward growth trend since the slowdown in 2020 and grew by 8.1% in 2022, recording the highest growth during the last five years. The increase in healthcare awareness post-pandemic and a rise in vehicle sales have supported the growth of general insurance,” said Sutirtha Dutta, Insurance Analyst at GlobalData.

The growth is attributed to several factors including increased healthcare awareness post-pandemic, rising demand for natural catastrophic (Nat-cat) insurance due to climate change, and increases in property and motor insurance premium rates.

Personal Accident & Health is the leading line of business, accounting for 34.8% of the premiums in 2023.

There has been a notable rise in the membership of private health insurance, which grew by 2% in 2022. Approximately 55% of the Australian population now has private health insurance.

ALSO READ: Bright 2024 ahead for Australian insurance industry – Jefferies report

Motor Insurance is the second largest, with a 24.8% share of the general insurance DWP in 2023. It is expected to grow at a CAGR of 10.3% from 2023 to 2027.

Growth drivers include increased vehicle sales and rising insurance premiums. New vehicle sales went up by 10% from January to August 2023 compared to the same period in 2022.

Property accounts for 24.4% of the general insurance DWP in 2023, it's the third-largest line of business. It is forecasted to grow at a CAGR of 13.6% from 2023 to 2027.

It will be driven by challenging market conditions leading to higher premiums and increased demand for NatCat policies due to extreme weather events.

Liability, Financial Lines, Marine, Aviation and Transit (MAT), and Miscellaneous insurance make up the remaining 16.0% of the general insurance DWP in 2023.

“The rise in premiums that will escalate the cost of living and make people selective while taking insurance is not expected to have a significant negative impact on the growth of the Australian general insurance industry during 2023-27. However, escalating NatCat losses and rising inflation will remain a key challenge for the profitability of Australian general insurers.” Dutta said.

Advertise

Advertise