How insurance can aid potential exposures under new patent system – Aon

China's IP office received around 1.62 million patent applications in 2022.

Navigating changes from the Unified Patent Court requires robust risk management strategies. Intellectual property liability insurance can help mitigate litigation risks and safeguard valuable assets, ensuring companies maintain a competitive edge in an evolving landscape, Aon pressed in an analysis.

“They should also consider intellectual property liability insurance to help ringfence this exposure. The combination of lower pricing, greater capacity and evolving coverage deems IP litigation insurance one of the key tools for helping manage rapidly changing risks and protecting balance sheets,” Aon said.

The launch of the Unified Patent Court in June last year represents a significant milestone, akin to the signing of the European Patent Convention 50 years ago. Companies with European operations must take note of this recent legislative change.

ALSO READ: Asia's protection gap leaves $59b uncovered – Aon

Patents grant exclusive rights to inventions, crucial for safeguarding innovation in a rapidly evolving landscape. With innovations like AI and green technologies driving competition, patent filings reached 3.46 million worldwide in 2022.

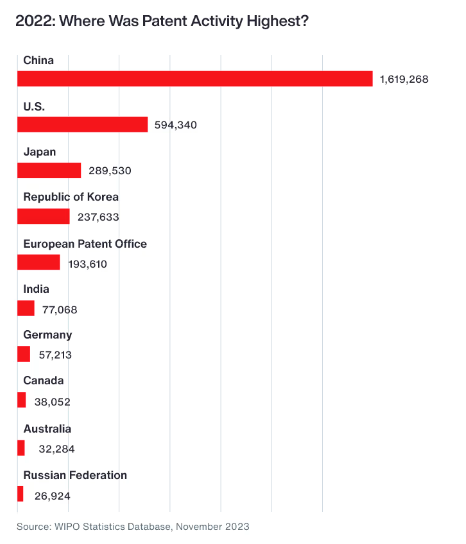

Patent activity is highest in China with 1.6 million patents recorded in 2022. This was followed by the US (594,340), Japan (289,530), South Korea (237,633), European Patent Office (193,610), and India (77,068).

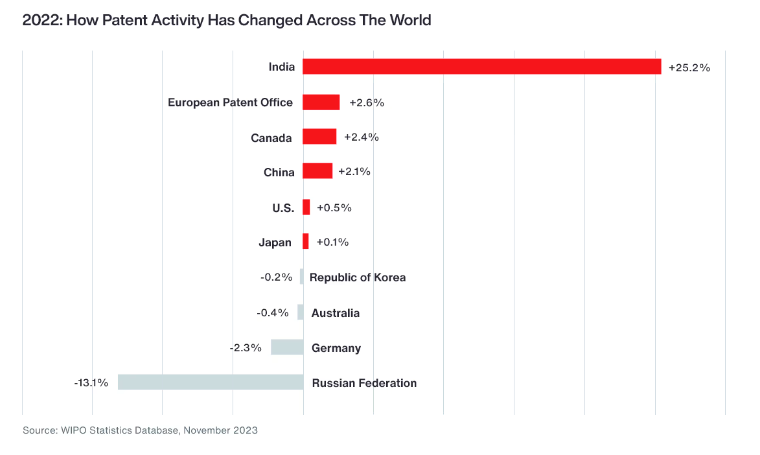

A significant change was noted in India, with patent activity growing 25.2%, the only double-digit growing market.

Before the Unified Patent Court, obtaining a European patent involved a complex process through the European Patent Office (EPO) or the European Patent Convention (EPC), requiring validation in individual countries.

Litigating in Europe was costly and complex, deterring many companies. The Unified Patent Court offers a streamlined approach to patent litigation across Europe, potentially increasing both frequency and severity of cases.

Multinational corporations are already leveraging this system, with smaller companies facing heightened risks from non-practicing entities (NPEs). Patent owners face decisions on whether to opt into the Unified Patent Court or maintain national litigation strategies. A mixed IP strategy may offer flexibility while protecting valuable patents.

Advertise

Advertise