9 in 10 ‘pawrents’ don’t have insurance for their pets – Prudential

Prudential policyholders are mainly concerned about timely emergency treatments and affordability.

About 86% of surveyed Prudential General Insurance Hong Kong customers owning pets lack pet insurance, highlighting a notable gap in coverage.

The Hong Kong Furkid Protection Survey also underscored the underestimation of potential veterinary expenses by pet owners, with 74% expecting annual treatment costs below HK$10,000, despite market data suggesting significantly higher expenses.

Moreover, among those not considering pet insurance (86%), only 23% plan to do so, citing reliance on savings and concerns over claims process complexity as major deterrents.

Top concerns for pet owners include timely emergency treatment (62%) and affordability of ongoing medical expenses (51%), aligning with factors influencing pet insurance purchase decisions.

ALSO READ: Etiqa introduces tailored pet insurance in Singapore

“We saw growth in our pet insurance business in 2023, where the number of policies increased by more than 40% year-on-year, reflecting a continued rise in demand of furkid protection,” Kelly Mok, General Manager of Prudential General Insurance Hong Kong said in a press release.

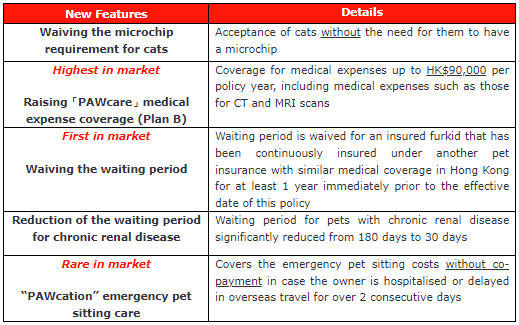

“Therefore, we have launched an enhanced version of our Furkid Care Insurance to address this and other evolving needs of customers. By offering the highest coverage in the market for veterinary expenses and by introducing market-first features, such as waiver of waiting periods for coverage switching, along with the market-rare emergency pet-sitting care, Prudential is at the forefront of pet insurance market with new advances in the types of protection it offers,” Mok added.

The upgrades for PRUChoice Furkid Care Insurance covers diverse medical needs of pets include:

Customers can benefit from a refund of up to 25% of the first-year annualised premium by successfully taking out the insurance from its PRUeShop, plus a one-year pet club membership with unlimited fee waivers for the night-time pet ambulance service.

Advertise

Advertise