NZ general insurance GWP to grow 7.3% annually

The industry is seen to climb 8.3% in 2024.

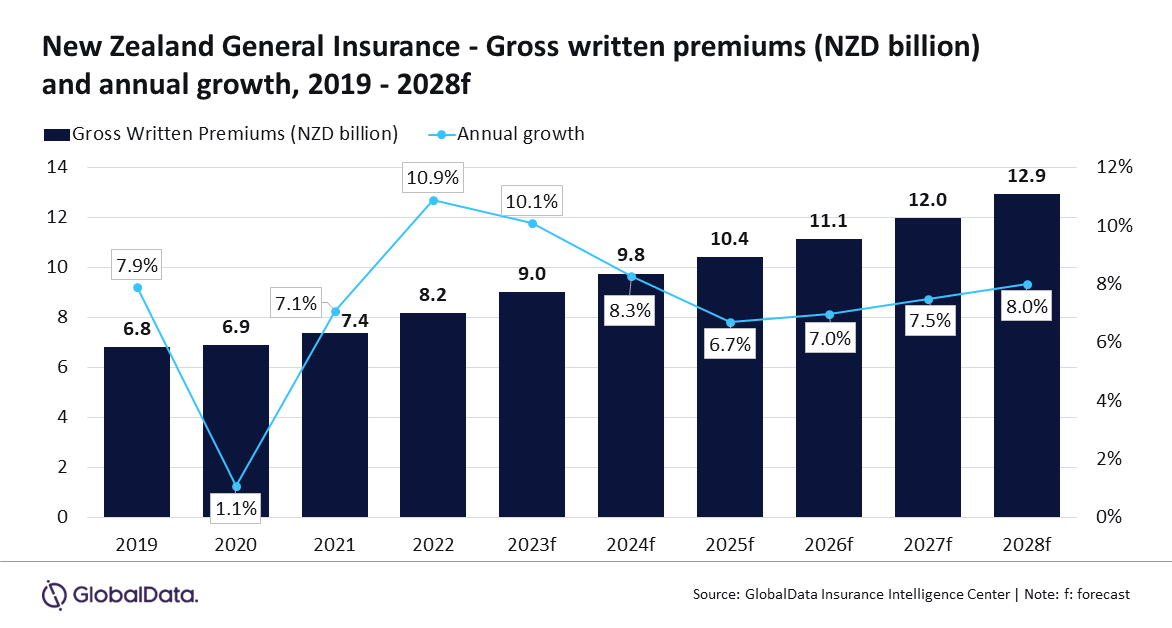

The New Zealand general insurance industry is projected to experience significant growth, with a compound annual growth rate (CAGR) of 7.3% from NZ$9.8b in 2024 to NZ$12.9b in 2028, in terms of gross written premiums (GWP), according to forecasts by GlobalData.

“New Zealand’s general insurance industry is expected to witness a growth of 10.1% in 2023 after growing by 10.9% in 2022. The growth is supported by a rise in the demand for natural catastrophic (nat-cat) insurance policies due to an increase in the frequency of extreme weather events and an increase in premium prices across most of the insurance lines driven by inflation,” Sneha Verma, Insurance Analyst at GlobalData said.

In 2024, the industry is expected to grow by 8.3%, primarily driven by property and motor insurance lines, which collectively contributed nearly 75% of the total general insurance GWP in 2023.

Property insurance holds the largest market share, accounting for 41.7% of the general insurance GWP in 2023, with a growth rate of 9.8% fueled by the increased demand for nat-cat insurance policies due to the country's vulnerability to extreme weather events.

The rise in weather-related claims has led reinsurers to raise reinsurance rates, subsequently increasing premium rates for home and agriculture insurance policies, further supporting property insurance growth.

Notably, contents and home insurance premiums saw significant increases in 2023, attributed partly to changes in the Earthquake Commission Cover (EQC) limit, which doubled coverage for natural calamities from $150,000 to $300,000.

“High inflation has also played a major role in an increase in property insurance prices. The annual inflation in New Zealand stood at 4.7% in 2023, much higher than the target band of 1% to 3% set by the Reserve Bank of New Zealand. Property insurance is expected to grow at a CAGR of 7.9% during 2024-2028,” Verma said.

ALSO READ: The global insurance market projects a 4.5% CAGR increase by 2027

Motor insurance, the second-largest line of business with a 32.9% market share in 2023, is also anticipated to grow, driven by premium rate increases influenced by inflation and high claim payouts following Cyclone Gabrielle.

Car insurance costs in 2023 surged by 30% on average compared to the previous year, reaching $1,190 in the third quarter.

Liability insurance, accounting for a 9.1% share of general insurance GWP in 2023, is expected to grow steadily, supported by mandatory classes of insurance such as professional indemnity insurance and the increasing frequency of cyber-attacks.

Cyber incidents rose by 20% in 2023 compared to the previous year.

Marine, aviation, and transit (MAT), along with other general insurance lines, made up the remaining 16.4% share of the general insurance GWP in 2023. Overall, the industry is poised for significant expansion over the forecast period.

“A gradual recovery in the economy after the pandemic and rising premium prices will support the growth of the New Zealand general insurance industry over the next five years. The insurers’ profitability is expected to remain volatile due to high claims arising from frequent natural disasters and a subsequent increase in reinsurance rates.” concluded Verma.

Advertise

Advertise