India’s private insurers outperform with tech edge

The market share of the top 10 insurers fell to 71.2% last year.

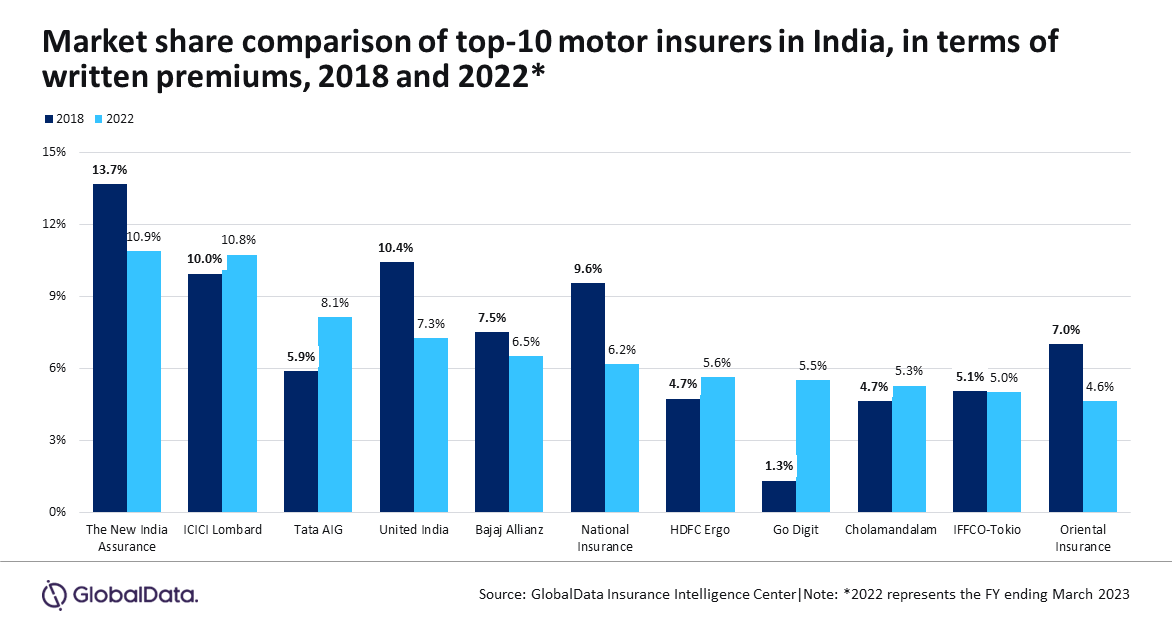

The competitive landscape of India's motor insurance industry experienced significant changes between 2018 and 2022.

New India Assurance and ICICI Lombard vied for the top position in 2022, whilst new entrants in the top 10 leveraged technology to enhance customer experience and capture market share, according to GlobalData.

GlobalData’s Insurance Database shows that the market share of the top 10 insurers fell from 78.3% in 2018 to 71.2% by March 2023.

This shift was driven by the underperformance of public sector insurers and aggressive strategies by private insurers like ICICI Lombard, Tata AIG, and Go Digit, leading to a decline in premiums for public insurers, except New India Assurance.

“Investments in technology to optimise operational efficiency and enhance customer experience, as well as strategic focus on product lines leading to new product developments, have supported private insurers to perform well compared to public insurers,” Swarup Kumar Sahoo, Senior Insurance Analyst at GlobalData, commented.

As of March 2023, New India Assurance remained the leading motor insurer, but ICICI Lombard is closing in. Tata AIG, which was seventh in 2018, rose to third place by increasing its market share by 2.2 percentage points.

Meanwhile, private insurers such as HDFC Ergo and Go Digit improved their rankings, while Oriental Insurance fell out of the top 10.

Sahoo highlights that the adoption of technologies like machine learning, AI, and automated claims processing has enabled private insurers to improve underwriting, reduce claim settlement times, and achieve higher claims settlement ratios. This technological edge has enhanced their market positioning and consumer trust.

ALSO READ: India's life insurance APE grows 22% YoY in April

In FY ending March 2023, Go Digit allocated 80% of its tech expenditure to motor insurance, followed by Tata AIG at 58% and ICICI Lombard at 56%.

These investments fueled significant premium growth: Go Digit grew by 38.2%, Tata AIG by 23.9%, and ICICI Lombard by 8.9%.

Technology has also transformed the customer experience. Digital policy issuance and claims settlement streamline processes and enhance customer satisfaction.

AI-powered chatbots offer personalised support, particularly in claims management, renewals, and grievances, giving private insurers an edge over public ones.

Private insurers are also expanding their product lines to cater to diverse customer preferences.

“Private insurers will need to grab opportunities presented by new technologies and continue expanding their product offerings to remain competitive. Streamlining claim settlements, enhancing the customer experience and personalisation will support private insurers in establishing their dominance in the Indian motor insurance industry over the next five years.” concluded Sahoo.

Advertise

Advertise