India's life insurance market to grow 10% annually

The industry is projected to reach $216.1b by 2028.

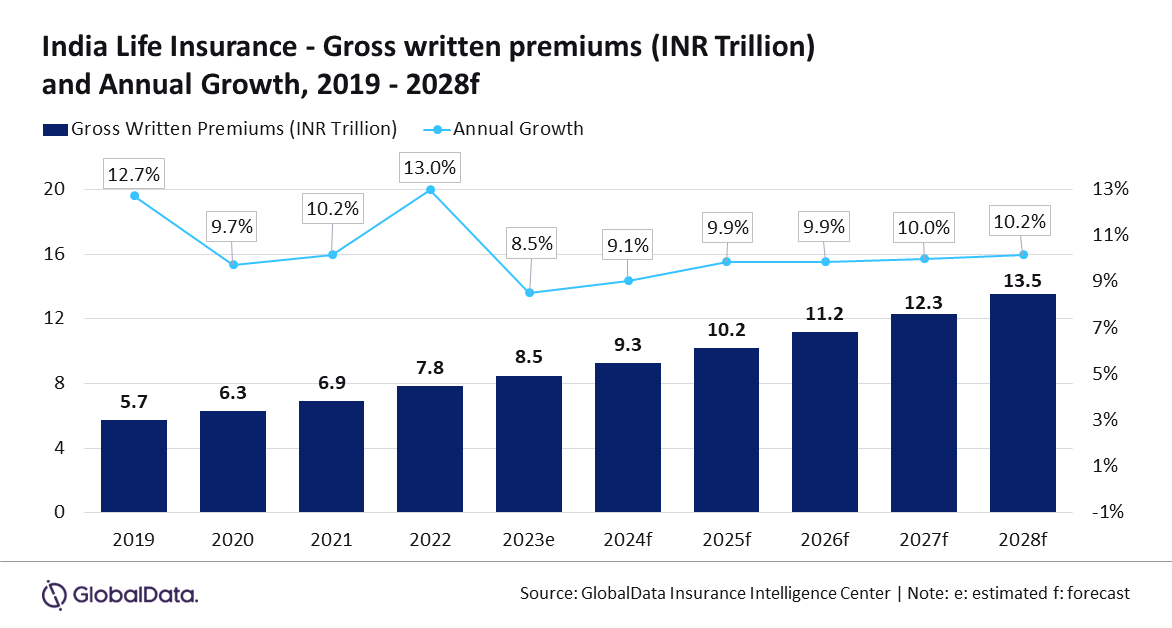

India’s life insurance industry is projected to grow at a CAGR of 10% from $151.7b in 2024 to $216.1b by 2028 in terms of gross written premiums (GWP), according to GlobalData, a leading data and analytics company.

After a slowdown in 2023, the industry is expected to regain momentum in 2024, driven by increased demand for traditional life insurance policies.

“As inflation persists above the 4% target, the relatively high-interest rate environment with a 6.5% key policy rate is anticipated to remain unchanged throughout 2024. This higher interest rate, combined with the positive economic outlook, will bolster the introduction of new products and drive demand for non-linked life insurance policies,” Aarti Sharma, Insurance Analyst at GlobalData said.

New regulations promoting inclusivity and advancements in insurtech are anticipated to facilitate the introduction of new products and expand insurance coverage.

Non-linked insurance policies are expected to dominate, accounting for 87.5% of total life insurance GWP in 2024, benefiting from high interest rates and offering better investment results.

Non-linked policies are forecasted to grow at a CAGR of 10.4% from 2024 to 2028.

ALSO READ: India’s private insurers outperform with tech edge

The International Monetary Fund (IMF) has revised India’s GDP growth projection upward to 6.8% in 2024 and 6.5% in 2025, supported by robust domestic demand and a growing working-age population, which bodes well for the life insurance industry.

The Insurance Regulatory and Development Authority of India (IRDAI) has issued guidelines to expand insurance coverage in rural areas, directing insurers to cover a specified number of lives under individual or group policies in gram panchayats.

This initiative aims to increase life insurance uptake in rural areas and is effective from April 1, 2024.

Digitalisation and advancements in insurtech are expected to ease insurance access and further support industry growth.

Insurers are increasingly leveraging technology such as AI, blockchain, and machine learning to enhance services.

AI-powered chatbots and virtual assistants are being used to provide real-time customer support, offer information about insurance products, and assist in the purchasing process.

This improves customer experience and boosts sales conversion rates, while also aiding in faster claims processing and fraud detection.

“The Indian life insurance industry is undergoing significant transformation with the increasing adoption of technology by insurers and digitalisation initiatives by the government. With favourable economic conditions and regulatory reforms, the life insurance industry in India is set for sustained growth over the next five years.” predicts Sharma.

Advertise

Advertise