Japan's top insurers unsafe amidst reliance on individual life

Over-reliance on one product will stunt sector growth.

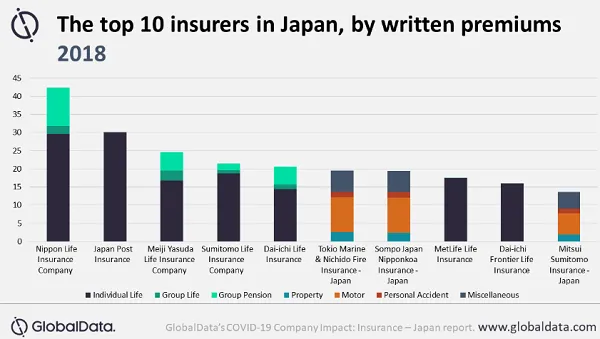

The top Japanese insurers’ dependence on the individual life business will render them vulnerable to rising claims and declining investments, a GlobalData report revealed.

The over-reliance on one product will eventually hamper the growth of the insurance sector with the leading five players – Nippon Life, Japan Post Insurance, Meiji Insurance, Sumitomo Life, and Dai-ichi Life – being particularly reliant.

“The top 10 insurers generate 77% of business from life and pensions. Seven of the top 10 insurers generate all of their business from these lines. Dependence on life insurance makes most of the top insurers vulnerable to the expected stagnancy in premium growth, as well as low investment returns prevalent in the business,” said analyst Deblina Mitra.

The sixth and seventh-placed insurers, Tokio Marine and Sompo Japan Nipponkoa, appear well-placed to increase their market share, as they are largely reliant on motor and property insurance, the report said.

Even if Japan has not been hit as hard as the pandemic and the sector is better equipped to deal with the fallout, its life insurers will still be hurt by the volatility in the global investments, adds Mitra.

“The insurers are likely to be impacted by the slowdown underway in this business, both due to low returns and stagnant premium growth. Japan Post and Nippon Life appear the most exposed in this regard.”

Advertise

Advertise