India

Indian e-commerce firm Paytm buys out Raheja QBE General Insurance

Former owners Prism Johnson and Australia's QBE will divest.

Indian e-commerce firm Paytm buys out Raheja QBE General Insurance

Former owners Prism Johnson and Australia's QBE will divest.

India urges insurers to offer COVID-specific health policies

A lump sum benefit equal to 100% of the sum insured shall be payable.

Premium downfalls still plague India's general insurers

Gross direct premiums fell 9.8% in May.

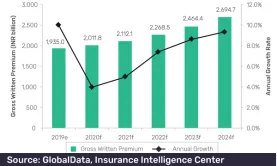

India's general insurance sector to decelerate 4% in 2020

Sector growth has been adjusted at a CAGR of 6.2%.

Indian non-life insurance premiums dwindle 10.6% in April

Monthly premiums declined 11.3%, with the motor segment plunging 49%.

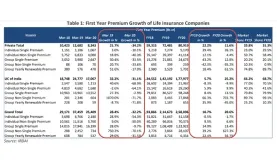

Indian life insurance sector to shrink 0.9% this year

The sector has reported a 32.6% decline in new business premiums in April.

India's life insurance posts 32.2% drop in first year premiums for March

Life Insurance Corporation of India continues to lose its market share.

Slowing economy to drag on Indian insurers' premium growth

But the low rate of insurance penetration is an opportunity for continued expansion.

Indian insurers see modest growth for FY2020 at 4-15%

Coverage stocks will likely meet annual premium equivalent (APE) growth expectations.

Ping An invests $70m in Indian auto tech firm CarDekho

This is Ping An’s first venture investment in India.

Motor policyholders in India blame insurers for lapsed policies: survey

Around 36% specifically blamed their insurer whilst 23% pinned the blame on their agent.

Indian banks urged to have cyber insurance

Smaller banks have insufficient coverage which does not cover cyber heists.

India's national health insurance scheme embraces trusts

Out of the 26 states, an overwhelming 20 are opting for trusts.

Indian insurers to shoulder interest payments of delayed rural claims

Companies failing to clear crop loss claims within 2 months have to pay with 12% interest.

Bajaj Allianz CEO reveals how their profits grew at a 46% CAGR in the last five years

Not succumbing to the price war and a risk-based underwriting model has indeed paid off.

Advertise

Advertise